NH PA-34 2024-2025 free printable template

Show details

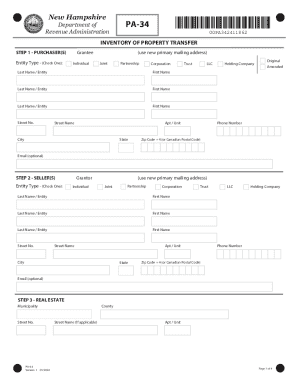

Print Form New Hampshire Department of Revenue Administration Reset Form *00PA342411862* PA-34 00PA342411862 INVENTORY OF PROPERTY TRANSFER STEP 1 - PURCHASER(S) Entity Type - (Check One): Grantee

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new hampshire pa34 transfer form

Edit your nh pa 34 property form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nh pa34 property transfer online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nh pa 34 transfer printable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nh pa34 inventory property download form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH PA-34 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nh pa 34 inventory property download form

How to fill out NH PA-34

01

Start by downloading the NH PA-34 form from the New Hampshire Department of Revenue Administration website.

02

Fill out your personal information, including your name, address, and Social Security number at the top of the form.

03

Enter the type of tax return you are filing – either for yourself or on behalf of a business.

04

Provide information regarding your income sources, including wages, rental income, and interest.

05

Report any applicable deductions and credits that you qualify for, following the instructions provided.

06

Calculate your total income, deductions, and tax due as outlined in the form.

07

Double-check all entries for accuracy before signing and dating the form.

08

Submit the completed NH PA-34 form electronically or by mailing it to the appropriate state department address.

Who needs NH PA-34?

01

Anyone who is subject to New Hampshire's Interest and Dividends Tax needs to complete the NH PA-34.

02

Individuals who earn income from interest and dividends over a certain threshold are required to file this form.

03

Taxpayers who wish to report their earnings accurately and fulfill their tax obligations in New Hampshire.

Video instructions and help with filling out and completing nh inventory property transfer blank

Instructions and Help about pa 34 transfer edit

Fill

nh pa34 transfer form fillable

: Try Risk Free

People Also Ask about nh pa 34 instruction online

How much tax do you pay when selling a house in NH?

Yes — there is some amount of closing costs for sellers in every state. In addition to paying the real estate agents involved in the transaction (typically around 6 percent of the sale price), sellers in New Hampshire must pay a real estate transfer tax of $0.75 per $100 of value. (The buyer also pays the same amount.)

How is NH transfer tax calculated?

The New Hampshire real estate transfer tax is $0.75 per $100 of the full price of or consideration for the real estate purchases.

Who pays real estate transfer tax in New Hampshire?

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable? All contractual transfers are subject to tax unless specifically exempt under RSA 78-B:2.

How much is NH real estate transfer tax?

About The New Hampshire Real Estate Transfer Tax The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of $. 75 per $100 of the total sale price. For transactions of $4,000 or less, the minimum tax of $40 is imposed (the buyer and seller are each responsible for $20).

How would you calculate the transfer tax?

The transfer tax is calculated as a percentage of the sale price or the appraised value of the property. The percentage will vary depending on what the city, county, or state charges. For the most part, the rate is calculated per $100, $500, or $1,000. If the transfer tax is $1.00 per $500, the rate would be 0.2%.

How do I add a name to a deed in NH?

The only way to change, add or remove a name on a deed is to have a new deed drawn up. Once a document is recorded, it can not be changed. To show any change in ownership of property, you need to have a new deed drawn up.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pa34 inventory transfer download directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your new hampshire pa 34 transfer pdf as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify nh pa 34 property instruction print without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your pa 34 property transfer form download into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete new hampshire pa 34 instruction form on an Android device?

Use the pdfFiller app for Android to finish your nh pa 34 transfer form printable. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NH PA-34?

NH PA-34 is a tax form used in New Hampshire for reporting the income and financial details of certain types of businesses, including partnerships and S corporations.

Who is required to file NH PA-34?

Partnerships and S corporations that conduct business in New Hampshire and have taxable income are required to file the NH PA-34.

How to fill out NH PA-34?

To fill out NH PA-34, gather financial information, such as income, expenses, and distributions, and complete the form accurately following the instructions provided by the New Hampshire Department of Revenue Administration.

What is the purpose of NH PA-34?

The purpose of NH PA-34 is to report income, deductions, and credits for partnerships and S corporations operating in New Hampshire, ensuring compliance with state tax laws.

What information must be reported on NH PA-34?

NH PA-34 requires reporting of total income, deductions, member distributions, and any other relevant financial data that reflects the business's operations during the tax year.

Fill out your NH PA-34 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nh pa34 Form is not the form you're looking for?Search for another form here.

Keywords relevant to nh pa 34 transfer form pdf

Related to new hampshire pa 34 form blank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.